$Vape stock trends, top companies, and market outlook for investors seeking growth opportunities in the vaping industry.

If you have noticed all the buzz surrounding vape companies and started wondering whether vape stocks might be the next big growth play, you are not alone. I remember having a cup of coffee with one of my mentors back in 2021 when the topic first came up. I asked him, Do you think vaping could actually replace traditional tobacco as a major investment trend. He smiled, took a slow drag from his cigarette, and replied, perhaps. But suppose it was a comber coaster, not a calm voyage. Fast forward to 2025, and his words could not have been nay. The request is alive with movement, driven by regulations, technology, and changing consumer habits.

In this article, I will walk you through the vape stock landscape as it stands today. We will look at real-time market data, explore top-performing companies, analyze industry trends, and break down the risks and opportunities you need to know before diving in. Whether you are an experienced investor or simply vape-curious, this guide is meant to help you make sense of it all.

Real-Time Market Data Snapshot

Let us begin with what investors care about most: numbers. Below is a look at some of the most recognized publicly traded companies connected to vaping and alternative nicotine products.

Altria Group Inc. (MO) currently trades at around $64.67 USD with a minor daily change of 0.09. It hit an intraday high of $64.96 and a low of $64.35. The company has strong liquidity and continues to attract attention from income investors because of its dividend stability.

British American Tobacco Plc (BTI) sits at approximately $52.07 USD, showing a daily gain of about 0.22. It opened the day at $51.78 and has global exposure in both tobacco and vaping segments.

| Ticker | Company | Current Price | Market Cap / Highlights |

| RLX RLX Technology Inc. | China-based e-vapor company | Around $2.43 USD | Market cap near US$2.9 billion |

| MO Altria Group Inc. | U.S. tobacco and vaping player | Around $64.67 USD | Major diversified company |

| BTI British American Tobacco Plc | British multinational tobacco and vape firm | Around $52.07 USD | Large-scale international reach |

Prices are approximate and subject to daily fluctuations.

This snapshot gives us a starting point. Now, let us zoom out to understand what is driving this market globally.

Industry Overview and Key Trends

Market Size and Growth Potential

The global vaping ande-cigarette request has been expanding fleetly as adult smokers seek druthers that they perceive to be safer. Technological invention and flavour diversity have also boosted relinquishment. Still, this is an assiduity under a microscope. Regulatory bodies continue to estimate and circumscribe, which adds unpredictability to stock performance.

To give an idea of the growth pace, RLX Technology formerly reported a profit increase of over 140 percent time-over-year during its earlier growth phase. Still, that instigation has braked because of new restrictions in China, where the utmost of its guests are grounded.

Changing Consumer Behaviour

Consumer geste is shifting in fascinating ways. Adult smokers are increasingly experimenting with reduced- threat products similar to vape pens, nicotine sacks, and heated tobacco. On the other hand, health authorities are sounding admonitions about underage vaping, which leads to tighter regulations and public concern.

In short, the adult request is growing, but governments are nearly watching to ensure youth access is limited.

Regulation: The Double-Edged Sword

Regulation can either cover an assiduity or suffocate it. In China, vaping companies similar to RLX were heavily impacted when the government relaxed rules on one-cigarette deals. In the United States, the FDA continues to review which products can remain on shelves. Meanwhile, Europe is dealing with new flavour bans and taxation proffers.

As an investor, you need to watch these regulatory moves closely because they often decide whether a company’s stock soars or slides overnight.

Top Vape Stocks to Watch

Below are three crucial vape- related stocks that have drawn the attention of judges and investors worldwide. While I’m not offering investment advice, I’ll partake in some particular perceptivity on how these companies operate and why they’re worth watching.

1. RLX Technology (Ticker: RLX)

Company Overview: RLX Technology is a Chinese e-vapor company that quickly rose to fame after its IPO in 2021. It focuses on producing sleek vaping devices aimed at adult smokers.

Stock Summary: RLX trades around $2.43 USD in late 2025, within a 52-week range of roughly $1.57 to $2.84.

Pros:

- Expanding into new global markets beyond China.

- Moderate market cap of around $2.9 billion, leaving room for potential growth.

Cons:

- Heavy exposure to Chinese regulatory decisions.

- Profit margins fluctuate due to changing government rules and consumer shifts.

Analyst Sentiment: Some believe RLX is undervalued, arguing that once regulations stabilize, the company could experience a rebound. Personally, I once watched RLX shares drop by over 80 percent in a single year because of sudden government action. That experience taught me that in this sector, growth can disappear faster than vapor in the wind.

2. Altria Group (Ticker: MO)

Company Overview: Altria is one of America’s largest tobacco companies and a significant investor in alternative nicotine products. Although it is not a pure vaping company, its involvement in the space gives it both stability and exposure to innovation.

Stock Summary: Currently trading around $64.67 USD, Altria remains a steady performer with a generous dividend yield.

Pros:

- Strong balance sheet and global distribution networks.

- Diversified across multiple nicotine categories, including vaping, heated tobacco, and smokeless products.

Cons:

- Slowing cigarette sales continue to weigh on overall growth.

- Regulatory scrutiny in the United States remains intense.

Investor Insight: Altria is what I like to call a bridge stock. It connects the old-world tobacco model with the new era of reduced-risk nicotine products. It might not shoot up overnight, but it offers stability in a volatile sector.

3. British American Tobacco (Ticker: BTI)

Company Overview: British American Tobacco is a multinational tobacco company with extensive global operations. Its portfolio includes traditional tobacco, vaping, and nicotine pouch products.

Stock Summary: BTI trades near $52.07 USD with a solid market presence across Europe, Asia, and the Americas.

Pros:

- International diversification helps offset local regulatory risk.

- Large cash flow allows for consistent dividends and product innovation.

Cons:

- Slower growth compared to smaller, tech-oriented competitors.

- Persistent health-related public perception challenges.

Investor Note: Think of BTI as the global safety net of the vaping world. It may not deliver explosive returns, but its broad footprint provides resilience against regional setbacks.

Market Risks and Future Outlook

When investing in vape stocks, it is easy to get caught up in the hype. I have done it myself. Once you see a double-digit price spike, it is tempting to believe the sky is the limit. Unfortunately, the clouds often roll in faster than you expect.

Key Risks

- Government Regulation: Changes in approval processes, taxes, and marketing laws can quickly affect profitability.

- Public Opinion: Negative health findings or social pressure could hurt demand.

- Competition: New entrants in the nicotine alternatives market, such as pouch or heated products, could divert attention and sales.

- Market Concentration: Many vape-focused companies rely heavily on one country, amplifying their risk.

- Profitability Volatility: As compliance costs rise, margins may shrink even when sales look promising.

Future Outlook

If regulations stabilize and companies adapt, the vape industry could grow steadily in the next five years. The transition toward harm-reduction products is real, but the path will not be smooth. In my view, investing in vape stocks feels like planting seeds in unpredictable soil. If the weather stays fair, the garden might flourish. If a storm hits, you could lose your crop overnight. Having been through a few such storms myself, I know the key is preparation and diversification.

Practical Investment Strategies

Here are a few lessons and strategies I have learned over time that can help you approach this space more confidently.

- Diversify Your Portfolio: Avoid putting all your money into one vaping company. Mix established players like Altria or BTI with smaller innovators if you are comfortable with higher risk.

- Track Regulatory Announcements: Set up news alerts for FDA, EU, and Chinese market updates. Policies can change faster than market prices adjust.

- Time Your Entries Around Earnings Reports: For instance, RLX has seen strong price moves around quarterly earnings. Watch for similar catalysts.

- Explore Broader ETFs: If you do not want individual stock risk, find ETFs that include vaping, tobacco, or cannabis-related holdings.

- Set an Exit Plan: Know when to step back. If a company faces new restrictions, reassess before losses compound.

- Focus on Long-Term Trends: The real opportunity lies in the gradual shift toward nicotine alternatives, not in quick speculation.

I learned this the hard way when one sudden policy tweet caused my small-cap vape stock to lose a quarter of its value overnight. Since then, I always invest with a clear exit strategy.

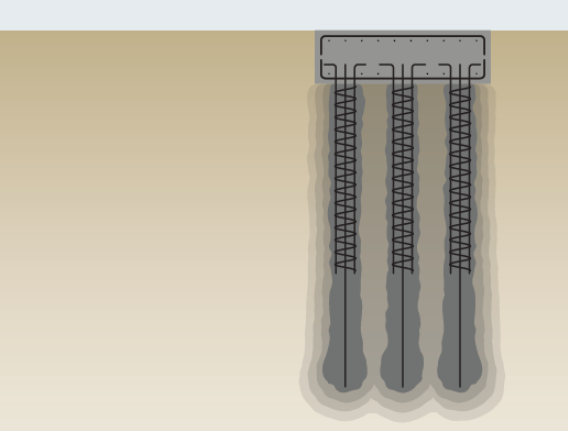

Quick Visual Reference

Imagine a simple map showing RLX’s stock price from 2021 to 2025. You would see an early swell, a dramatic fall, and also a slow rise back as the company adapts to new regulations. Alongside it, a comparison table could list each company’s pros and cons for easy scanning. These illustrations can help simplify your analysis before making any investment decision.

Summary and Call to Action

Vape stocks sit in a fascinating crossroads between consumer goods and health inventions. They offer instigative eventuality, but they also demand respect for the pitfalls involved. For every success story, there are investors who undervalued the power of nonsupervisory shifts.

Still, start small, study the companies, If you plan to explore this space. The vaping sector can deliver seductive returns, but only for those who stay informed and nimble.

Additional Resources

- NASDAQ: VAPE Official Page: Official NASDAQ listing for CEA Industries (VAPE) showing stock activity, key statistics, and fundamental company information.